- Capitol Bee

- Posts

- "No New Taxes" vs. $2 Billion in Trade-Offs: What Kansas Is Giving Up to Land the Chiefs

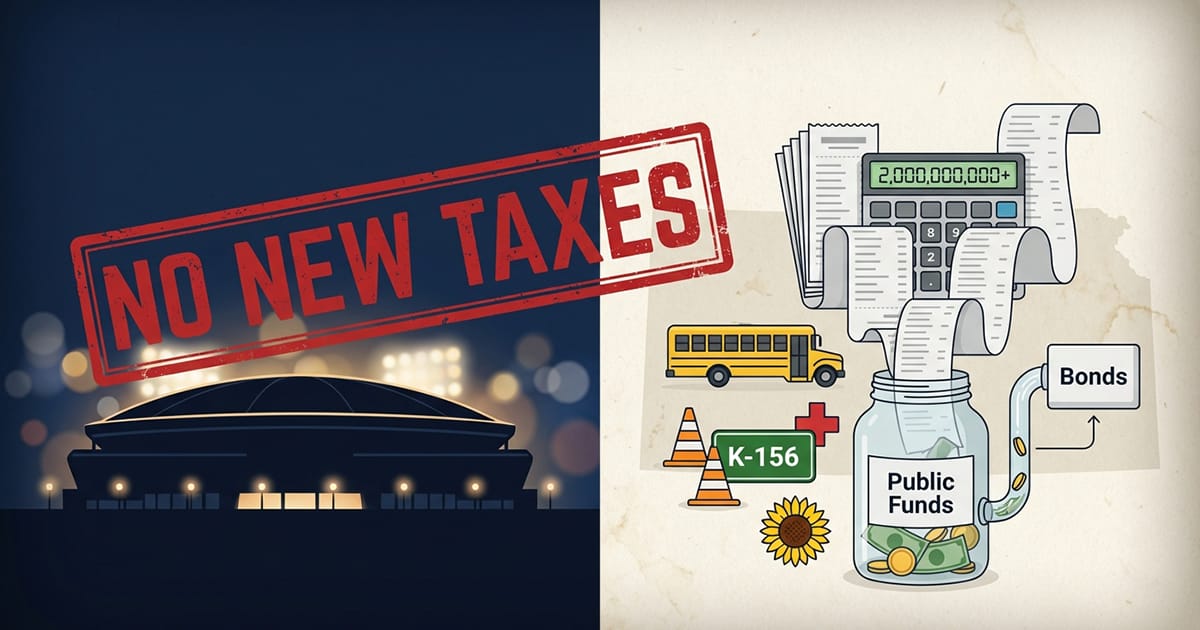

"No New Taxes" vs. $2 Billion in Trade-Offs: What Kansas Is Giving Up to Land the Chiefs

The stadium deal won't raise your tax rate. But it will redirect billions in tax dollars we could have spent on other Kansas priorities. Here's what we're trading away—and the questions you should be asking before the concrete gets poured.

Table of Contents

The Short Version

It started with a fumble.

On April 2, 2024, Jackson County, Missouri voters decisively rejected a sales tax extension that would have funded renovations to Arrowhead Stadium and a new downtown ballpark for the Royals. The vote wasn't close1 (58% said no).

Within days, a well-connected lobbying operation sprang into action on the Kansas side of the state line. Former Kansas House Speaker Ron Ryckman Jr.2 —who'd led the House from 2017 to 2023, the first speaker in state history to serve three consecutive terms3 —helped launch a group called "Scoop and Score4 ," named for the football play where a defender grabs a fumble and runs it back for a touchdown. His former chief of staff, Paje Resner, incorporated the nonprofit on May 13, 2024. By the time lawmakers convened for a special session five weeks later, Scoop and Score had registered 30 lobbyists.

The metaphor wasn't subtle. "Jackson County fumbled," Ryckman said in a text message to the Kansas City Star shortly after the vote5 . "Now there will be a mad scramble for the ball and we're in the best position for a scoop and score."

What happened next moved fast. On June 4, Senate President Ty Masterson and House Speaker Dan Hawkins (both Republicans) made public a letter to Chiefs owner Clark Hunt, inviting the team to "weigh in" on legislation Kansas was drafting. On June 17, lawyers for the Chiefs testified at the Statehouse6 . The next day, the Legislature passed HB 2001 by votes of 84-38 in the House and 27-8 in the Senate. Governor Laura Kelly, a Democrat, signed it on June 21.

The bill supercharged Kansas's existing STAR bond program specifically to land a major pro sports franchise. It passed with bipartisan support and unusual speed—written, debated, and enacted in a matter of weeks.

Eighteen months later, on December 22, 2025, the deal closed. Kansas officials announced9 the Chiefs would build a $3 billion domed stadium in Wyandotte County, with a headquarters and practice facility in Olathe. The state will use those STAR bonds to cover up to 60% of the stadium cost, capped at $1.8 billion of public money.

Here's the catch: "no new taxes" doesn't mean "no cost." Those STAR bonds work by capturing sales taxes, liquor taxes, and gambling revenues generated inside the stadium district and routing them to pay off the debt…for up to 30 years. That's money that would otherwise flow to schools, roads, and the state's general fund.

Think of it this way: Kansas isn't writing a check. It's pre-spending decades of future tax revenue on a single building.

What Actually Happened

Governor Laura Kelly and Chiefs ownership announced the deal on December 22, 2025. The Legislative Coordinating Council met behind closed doors the same day and voted unanimously to approve the financing framework. Target opening: the 2031 NFL season.

The project includes:

A new domed stadium in Wyandotte County (65,000+ seats, smaller than Arrowhead's 73,000+)

A headquarters and year-round practice facility in Olathe

Public funding capped at 60% of stadium costs, up to $1.8 billion

The Chiefs paying $7 million in annual rent (increasing each year)

A government or quasi-government entity owning the stadium for tax purposes

Most of the underlying documents stay confidential until July 1, 202910 .

How STAR Bonds Actually Work (Plain English)

STAR bonds are Kansas's way of financing big tourism projects without raising tax rates. Here's the basic idea:

The state draws a line around a "district" (in this case, the stadium and surrounding area)

Any sales taxes, liquor taxes, and certain gambling revenues generated inside that district get captured

That captured money pays off the construction bonds instead of going to the state's general fund

For most STAR bond projects, the state captures 90% of sales taxes. For major pro sports stadiums under the 2024 law (HB 200178 , signed June 20, 2024), they can capture all of it…for up to 30 years11 .

The law also gives state officials unusual flexibility in setting the "base year"—the benchmark used to calculate how much new revenue the district generates. That's an obscure technical detail that can dramatically affect how much money gets diverted.

Why "No New Taxes" Isn't the Whole Story

Let's be precise about what state leaders are saying (and what they're not).

What's true: This deal doesn't raise your tax rate. No new sales tax. No income tax hike. No special stadium tax on your property.

What's also true: The taxes you already pay will be redirected. For potentially three decades, sales taxes generated at and around the stadium won't fund schools, fix highways, or provide property tax relief. They'll pay off stadium debt.

In other words: your tax rates don’t change as a result of this deal. But it’s similar to getting a second mortgage; there is a new bill to pay, regardless of what happens to the state’s income.

The Opportunity Cost: What Else Could $2 Billion Buy?

Here's where the math gets uncomfortable. The stadium's public share is roughly the same scale as several major Kansas policy choices:

The 2024 tax relief package (SB 1)12: Governor Kelly's office estimates it delivers about $2 billion in tax relief over five years. That's the same ballpark as the stadium's public commitment over time. One gives money back to taxpayers. The other builds a building for a billionaire-owned team.

Medicaid expansion: The Kansas Health Institute estimates expanding Medicaid would cover about 152,000 Kansans at a net state cost of roughly $171 million over 10 years (after federal matching)13 . That's a fraction of the stadium cost.

School funding context: The statewide 20-mill property tax levy raises about $856 million per year for schools14 . The stadium's public commitment equals roughly 2+ years of education funding.

The Panasonic comparison: Kansas offered about $829 million in incentives for the Panasonic battery plant in De Soto15 . That deal is tied to job creation and investment milestones. The stadium deal has different economics and different assumptions about what counts as "new" economic activity, but dollar-for-dollar the Panasonic incentives generate more than twice as much economic impact and job growth.

None of this means the stadium is necessarily wrong. But it means Kansas is making a choice.

What the Economists Say (Spoiler: They're Skeptical)

This is where the deal's proponents face a real credibility problem.

The Kansas Department of Commerce projects the stadium will generate "over $1 billion in annual economic impact." That sounds enormous. But here's what decades of academic research actually shows:

A 2022 survey of more than 130 studies published in the Journal of Economic Surveys concluded16 : "Local economic activity is by and large unaffected by sports stadiums, and the level of venue subsidies typically provided far exceeds any observed economic benefits."

When prominent economists were surveyed17 :

83% agreed stadium subsidies cost taxpayers more than the benefits generated

86% agreed states should eliminate such subsidies

J.C. Bradbury, a Kennesaw State economist who studies stadium deals: "There's zero justification for taxpayers putting a dime for professional sports stadiums."

Geoffrey Propheter, a University of Colorado Denver professor who's analyzed the Kansas deal specifically, estimates the true public cost could reach $6.3 billion in nominal terms over the life of the bonds18 .

This isn't a both-sides debate among economists. The consensus is overwhelming and has been for decades.

Sports Betting: Don't Count on It

Part of the stadium financing relies on sports betting revenues exceeding a $71.49 million threshold, with the overflow going to a special sports fund.

Here's the problem: Kansas sports betting has been underwhelming.

Since launching in September 2022, the state has collected about $36 million total in sports betting taxes19 . Kansas captures only 0.6% of money wagered; in September 2025 legislative testimony, Representative Francis Awerkamp called it an "absolute failure." The 10% tax rate on operator profits, combined with generous promotional deductions, means the state collects far less than the raw wagering numbers suggest.

What Happens in Johnson County

The Olathe headquarters and practice facility will trigger local decisions that hit closer to home for JoCo residents.

Expect city and county leaders to consider:

IRBs (Industrial Revenue Bonds): Sales tax exemptions on construction materials

Property tax abatements: Reductions on the facility's tax bill

Infrastructure costs: Roads, utilities, and other improvements to support the site

County Commission Chairman Mike Kelly20 and Olathe Mayor John Bacon have been enthusiastic, calling it a "once-in-a-generation opportunity." But enthusiasm isn't the same as a detailed cost-benefit analysis.

The questions for local leaders: What exactly is being abated? For how long? What infrastructure costs will the city and county absorb? And how are local taxpayers protected if the projections don't materialize?

What the Law Quietly Changed

Two provisions in HB 2001 deserve more attention than they've received:

Aggressive revenue capture: For major pro sports projects, the state can now divert up to 100% of state sales taxes from the district—up from the usual 90% cap. Combined with liquor taxes and the sports betting overflow, that's an unusually large share of revenue locked up for bond repayment.

Limited transparency: The Legislative Coordinating Council can negotiate behind closed doors, and most deal documents stay confidential until July 1, 2029…unless officials choose to extend that deadline. Otherwise, the details stay sealed for years.

Questions Officials Should Answer Before Bonds Are Sold

What's the full public cost—state and local combined—by year? Show a consolidated schedule and a worst-case scenario if sales underperform.

Where exactly are the district boundaries, and why? District lines determine how much revenue gets captured. Who drew them?

What's the base year, and who chose it? This technical detail affects how much money gets diverted. The law gives officials broad discretion here.

If revenues fall short, who covers the gap? Are there reserves? Does the state backstop the bonds? What are the actual risks to taxpayers?

What are we choosing not to fund? Name the specific projects, tax relief, or services that will be delayed or reduced to accommodate this commitment.

When will the public see the full documentation? The 2029 confidentiality deadline is a long time to wait for transparency on a multi-billion-dollar commitment.

What We Know and What We Don't

We know:

The public stadium commitment is capped at $1.8 billion (60%)

STAR bonds can run for 30 years

The deal captures 100% of state sales taxes from the district

Documents stay confidential until 2029

Academic consensus on stadium subsidies is overwhelmingly negative

Kansas has had STAR bond failures before

We don't know:

The actual district boundaries and base year

Detailed revenue projections and stress-test scenarios

The full scope of local incentives in Olathe and Wyandotte County

Bond covenants and taxpayer protections

What contingencies exist if the Chiefs leave or revenues disappoint

The Bottom Line

This deal may be the right choice for Kansas. But "no new taxes" shouldn't end the conversation. It should start it.

What we're really debating is whether a domed stadium for a billionaire-owned football team is the best use of $2 billion in future tax revenue. That's money that could go to schools, roads, property tax relief, healthcare, or simply staying in taxpayers' pockets.

The economists are skeptical. The precedents are cautionary. The transparency is limited. And the commitment lasts a generation.

Those aren't reasons to automatically oppose the deal. But they're reasons to demand answers before the concrete gets poured.

Have questions about the Chiefs deal or other Kansas policy issues? Reply to this email or reach us at [email protected]. Capitol Bee is a nonprofit civic journalism project of Civic Clarity, Inc.—we don't have a paywall because we believe transparent government reporting should be accessible to everyone.

Sources:

HB 2001 enrolled text, Kansas Legislature (signed June 20, 2024)

Kansas Department of Commerce, Chiefs Stadium Announcement and Term Sheet (Dec. 22, 2025)

Kansas Legislative Research Department, HB 2001 Summary (June 2024)

Kansas Health Institute, Medicaid Expansion Estimates (Feb. 2024)

Governor's Office, SB 1 Tax Relief Announcement (Aug. 2024)

Kansas Association of School Boards, 20-Mill Levy Data (2024)

Kansas Legislative Post Audit, STAR Bonds Evaluation (Oct. 2024)

Bradbury, Coates & Humphreys, "Professional Sports Facilities and Regional Economic Development," Journal of Economic Surveys (2022)

KCUR, Kansas Reflector, Lawrence Journal-World, KSHB coverage (Dec. 2025)

1 Jackson County Election Board, Question 1 Results (April 2, 2024)

2 Wikipedia, "Ron Ryckman Jr." (biographical details, speakership dates)

3 Ballotpedia, "Ron Ryckman" (legislative history)

4 Kansas Secretary of State, Scoop and Score Inc. Articles of Incorporation (May 13, 2024)

5 KMBC, "State senator from KCK discusses effort to lure Chiefs to Kansas" (June 5, 2024)

6 Kansas Reflector, "Chiefs, Royals ask Kansas for incentives to allow teams to leave Missouri" (June 17, 2024)

7 Kansas Legislative Research Department, Summary of 2024 Special Session HB 2001 (June 2024)

8 Kansas Legislature, HB 2001 Roll Call Votes (June 18, 2024)

9 Kansas Department of Commerce, Chiefs Stadium Announcement (Dec. 22, 2025)

10 Kansas Department of Commerce, Term Sheet "Project Monitor 2.0" Execution Version (Dec. 22, 2025)

11 HB 2001 Enrolled Text, Kansas Legislature (signed June 21, 2024)

12 Governor Laura Kelly's Office, SB 1 Tax Relief Announcement (Aug. 28, 2024)

13 Kansas Health Institute, "Estimating the Fiscal Impact of Medicaid Expansion" (Feb. 2024)

14 Kansas Association of School Boards, 20-Mill Levy Data (2024)

15 Kansas Department of Commerce, Panasonic APEX Incentives Announcement (July 2022)

16 Bradbury, Coates & Humphreys, "Do Professional Sports Facilities Generate Economic Development?" Journal of Economic Surveys (2022)

17 IGM Forum, Economist Survey on Stadium Subsidies

18 The Beacon, "Experts say that Kansas' STAR bond stadium plan is flawed" (May 30, 2025)

19 KCUR, "Kansas sports betting revenue" coverage (2024-2025)

20 Johnson County Government, Chairman Mike Kelly Statement (Dec. 22, 2025)